You may have heard of the recent amendments to the Income Tax Act 1961 for charitable organisations that was notified on March 26th, 2021. Let’s evaluate one of those amendments and how it can affect fundraising.

The burden of compliance is now shifting on to charitable organisations. Apart from the re-validation of 12A and 80G (read more about it here), a charitable organisation having an 80G approval needs to file a statement of donations in Form 10BD by May 31st in the immediately following financial year. This is effective from AY 2022-23 ie. from April 1st, 2021. Read more about the amendment here.

What is the impact of this amendment?

If we dive deeper, this amendment has far-reaching effects, beyond compliance. Let’s study a case and understand the situation pre-amendment and how it has changed post the amendment.

Assume Donor A is a regular contributor to XYZ Foundation. They donate a sum every year and love the impact that XYZ Foundation is creating. They are also happy they get a tax benefit along with the change they are helping to bring to society.

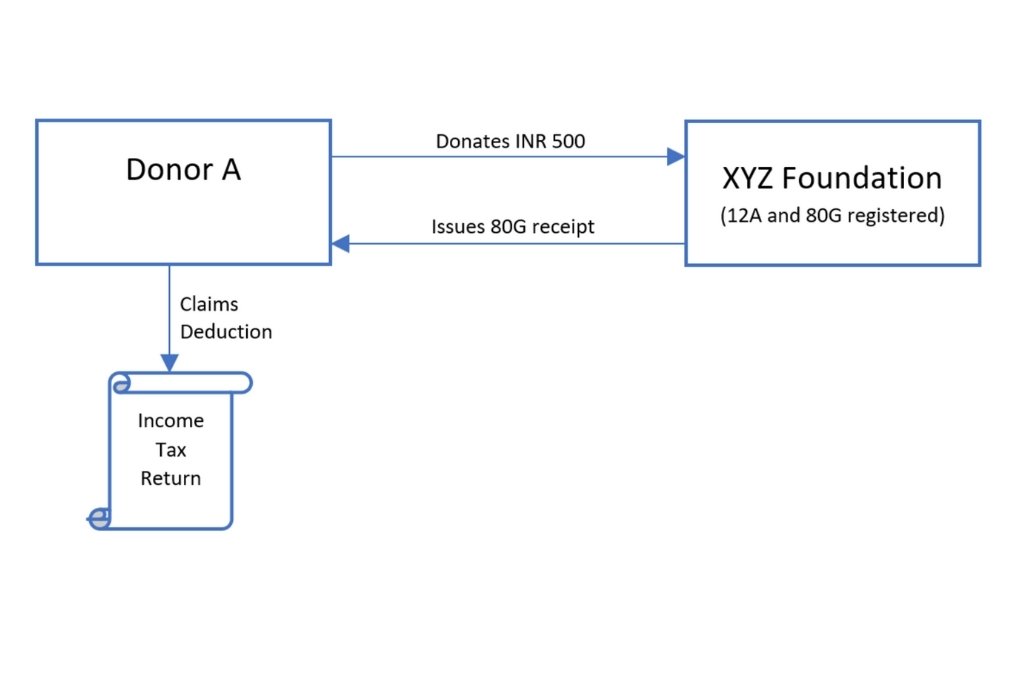

In Figure 1, you can see that pre-amendment, the process to avail the 80G deduction for a donor was quite simple. All that XYZ Foundation had to do was ensure a donation receipt was issued to Donor A with a valid 80G certificate. While filing their income tax returns, Donor A could easily avail 80G deduction for the donation given. XYZ Foundation had no other obligations to fulfill to ensure that Donor A was eligible to claim the benefit of 80G deduction.

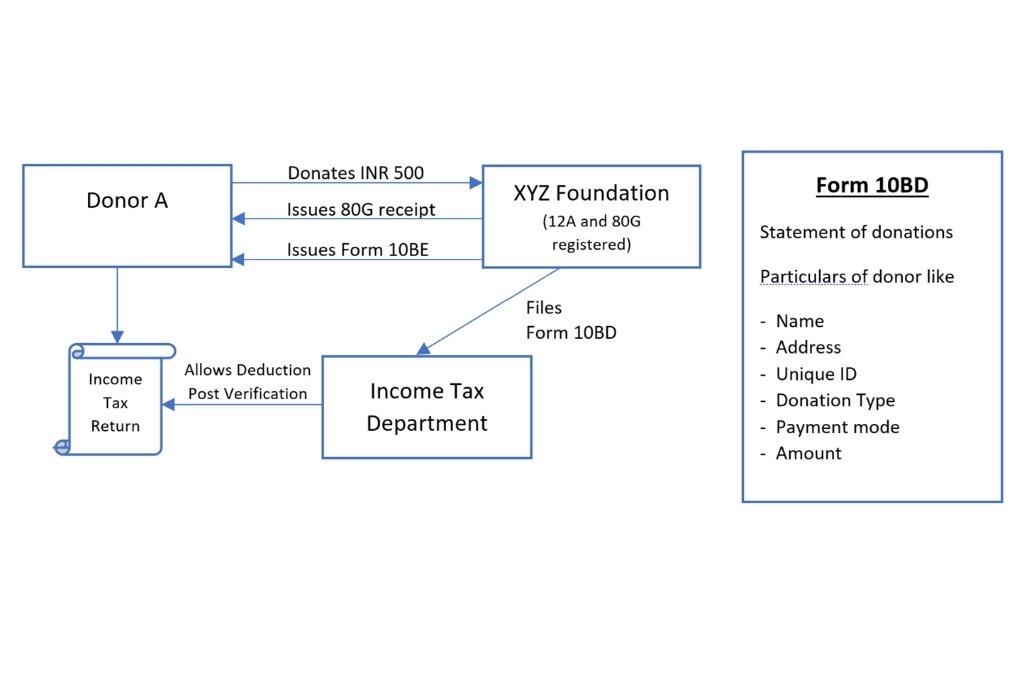

Now, let us evaluate Figure 2. It depicts how post-amendment, the 80G deduction will only be available if XYZ Foundation reports the correct information about Donor A to the Income Tax department via Form 10BD and then issues a certificate (Form 10BE) to Donor A. The deduction will be pre-filled in the donor’s Income Tax Return, similar to how TDS is retrieved, provided the deductor has filed a TDS return with appropriate particulars.

Pre-amendment, for every contribution made by Donor A, they were easily able to avail 80G deduction while filing their income tax returns year on year. All they needed was a valid receipt from XYZ Foundation. It was of no consequence whether XYZ Foundation maintained donor information or not. There was no direct way for the Income Tax department to match the contributions captured in the books of XYZ Foundation and 80G deductions claimed by various donors.

Post-amendment, ie. from April 1st, 2021 (AY 2022-23), XYZ Foundation has to report all the donations received by them (which are eligible for 80G deduction) to the Income Tax department in the notified Form 10BD. This form requires the following information:

- Donor name

- Donor address

- Donor unique ID number (PAN, Aadhaar, Tax Identification Number, Passport, others)

- Donation type (whether corpus, specific grant, others)

- Payment (mode whether cash, kind, electronic modes including cheque, others)

- Amount (in INR)

But how does this affect your fundraising?

Well, you need to file Form 10BD which would lead to the generation of Form 10BE. Form 10BE is a certificate that would ensure that the 80G deduction is available for the donor. Think of Form 10BE as a TDS certificate issued by the deducting organisation for its vendors. Without this, the benefit isn’t passed on. If XYZ Foundation fails to generate this in time or has incorrect or no information about its donors, loyal donors may lose faith in XYZ Foundation. First-time donors may reconsider giving again if claiming an 80G deduction is a hassle.

Act now and gear up to meet this important compliance requirement.

With crowdfunding on the rise, each charitable organisation must take the onus to ensure that all the essential donor information is being captured and maintained to meet compliance requirements, failing which the donor’s deduction could be jeopardised. This could affect the future fundraising capacity of the charitable organisation.

Additionally, not collecting some of this information could also have adverse consequences as they may be considered ‘anonymous donations’ under section 115BBC of the Income Tax Act.

There are penal provisions for not filing Form 10BD by May 31st of each year. Delayed submission of Form 10BD and/or Form 10BE will attract late fees under section 234G of the Income Tax Act at the rate of INR 200 per day and a penalty (ranging from INR 10,000 to INR 1,00,000) will be levied under section 271K of the Income Tax Act.

Act now

This is a daunting task. Act now and gear up to meet this important compliance requirement. Whether you are a charitable organisation with an INR 20 lakh budget or an INR 200 crore budget, whether you are funded by corporates or individuals or a mix of both, whether you receive funds from foreign or domestic sources you will need to file Form 10BD. Don’t lose out on funding because of compliance.

This is an edited version of an article that was originally published on Aria Advisory’s website.

—

Know more

- Read the notification and learn more about Forms 10BD and 10BE here.

Do more

- Visit ERP4Impact.com, a donations management platform to automate compliance processes related to donors and donations.