What is impact investing?

Impact investing refers to the act of making investments in companies, organisations, and funds, with the intention to generate positive, measurable social and environmental impact, alongside a financial return.

Financial returns for impact investments can range from simply recovering the original investment amount (the principal), all the way to matching commercial market returns. Impact may be demonstrated in various ways, including creating jobs, improving incomes, and/or serving low-income consumers through affordable housing, education, healthcare, or inclusive finance.

Impact investing in India began in earnest in 2001 with the establishment of Aavishkar, India’s first for-profit impact fund, and the entry of the nonprofit Acumen Fund.Who are impact investors?

An impact investor is an organisation or individual who invests money in a social enterprise, with the expectation of a financial return and positive impact for society at large.

In most cases, impact investors raise funds from different players to deploy them in multiple social enterprises. These funds could come from multiple sources:

– High net-worth individuals (HNIs) and family offices

– Angel networks

– Domestic and global foundations

– Development finance institutions (DFIs)

– Public and private sector banks, and insurance companies

– Institutional funds including pension, endowment, sovereign wealth, and venture funds

– CSR funds from corporates

Impact investing can also take place through funding platforms or exchanges like the Impact Investment Exchange based out of Singapore, or the proposed social stock exchange in India.How big is the impact investing market?

According to a study by the Global Impact Investing Network (GIIN), the current size of the global impact investing market is USD 502 billion. This capital is managed by more than 1,340 impact investors across the world. About half of these investing organisations are headquartered in the US, and about a quarter in Europe.

In India, the impact investing sector attracted over USD 5.2 billion between 2010 and 2016. There are about two million social enterprises, and at least 75 impact investors active in India. Over 90 percent of the investments made in India however, are by DFIs; which means that their behaviour drives most of the trends in this space.

In July 2019, Brookings India published a study to quantify the sector in India. They interviewed more than 25 impact investors, social enterprises, and stakeholders for the study. Here are some findings from their report.What are the main sources of funds?

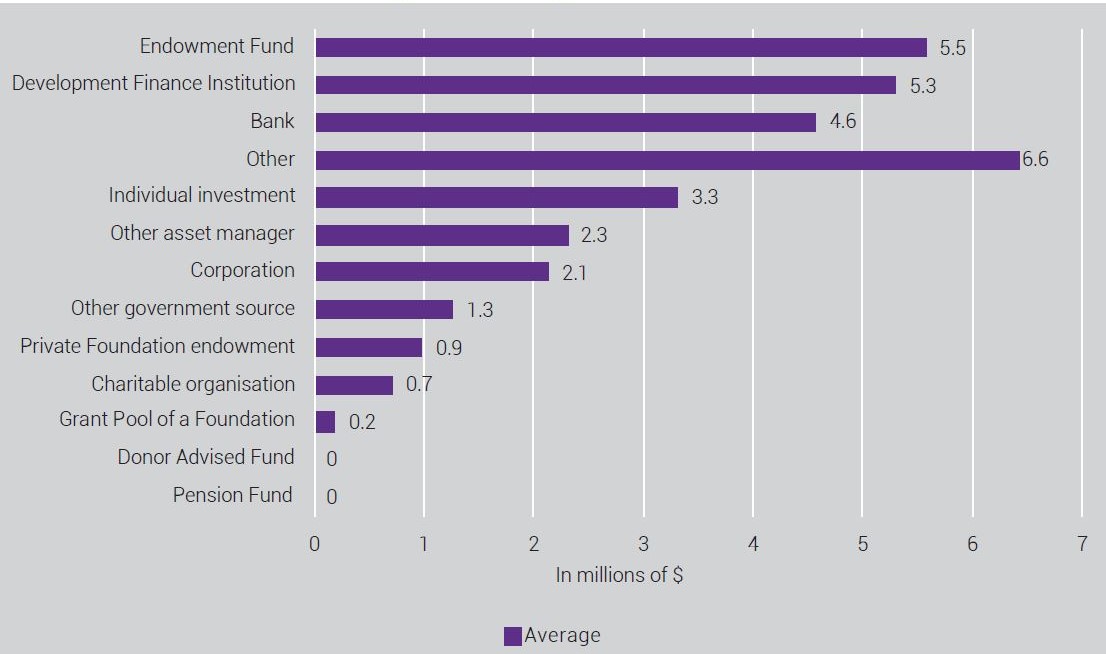

The chart below shows the amount of impact investing funds generated from different sources in India.

Funding sources, 2017 | Source: IIC data

The largest source, ‘others’, is dominated by ‘fund of funds’, including insurance companies. Notably, government and charitable organisations are relatively smaller contributors.What is the average size of investments?

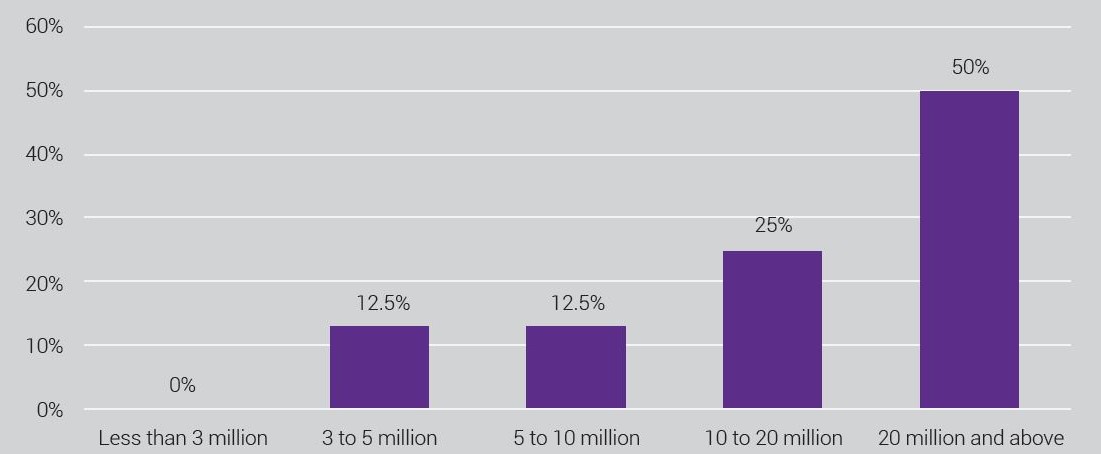

In financial year 2018, half the impact investors in India (those surveyed by Brookings India) had total investments of USD 20 million and above.

Value of investments, 2018 | Source: Brookings survey

The size of individual investments by these investors ranged between USD 1,00,000 and USD 10 million, and they were made to social enterprises at different stages of growth. Although a majority of the investments were seed or early-stage funding, the trend is shifting, with investments moving towards mid- and growth-stages.How are investments distributed across sectors?

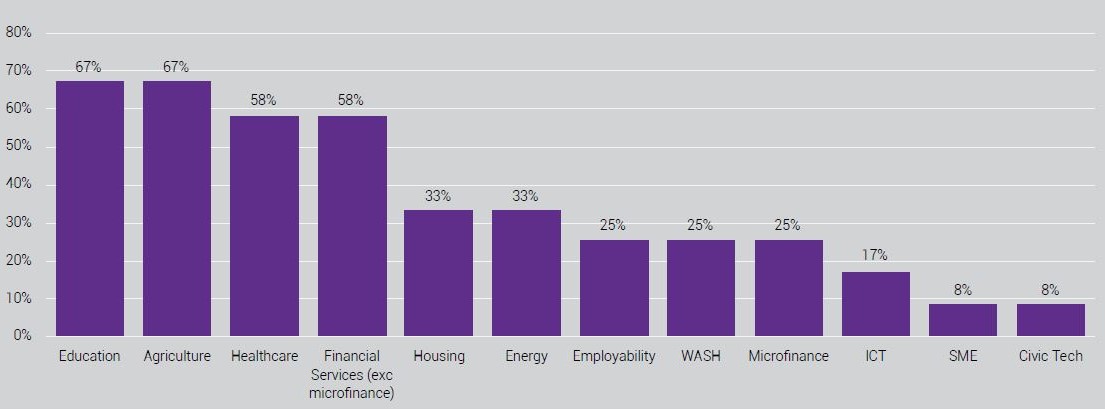

As per GIIN data, financial services, energy, and microfinance are the top sectors where global impact investors deploy capital. While up until 2017, the same could be said of India, there is a considerable shift now. The three sectors that have increasingly been getting a significant proportion of the impact investment funds are: health, education, and agriculture. The table below indicates the proportion of investors who invest in a particular sector.1

Investments across sectors | Source: Brookings surveyWhat are the average returns from investments?

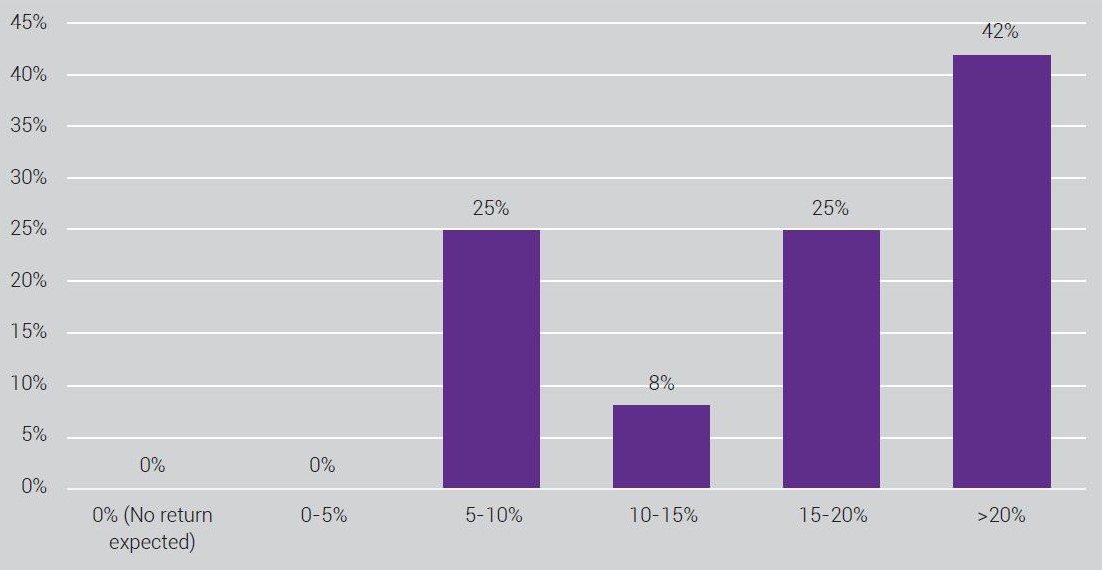

According to Ritu Verma, co-founder of Ankur Capital, “In India, the concept of impact investing is still nascent, and most traditional capital is not asking more from its money, in terms of impact. There is a concern that money with impact will require a compromise in returns. In reality, impact investment has delivered returns on par with, if not higher than, global standards.”

Nearly 42 percent of respondents in the Brookings study stated that their funds generated returns of more than 20 percent. Another 25 percent achieved returns in the 15-20 percent range, and eight percent of the respondents between 10-15 percent. Twenty five percent of impact investors achieved below market returns of between 5-10 percent.

Average rate of returns, 2018 | Source: Brookings survey

The expected returns for the various sub-sectors vary. It is, on average, greater than 20 percent for agriculture, 5-20 percent for education, 15-20 percent for healthcare, and 10-15 percent for financial services.What are some of the challenges impact investors face?

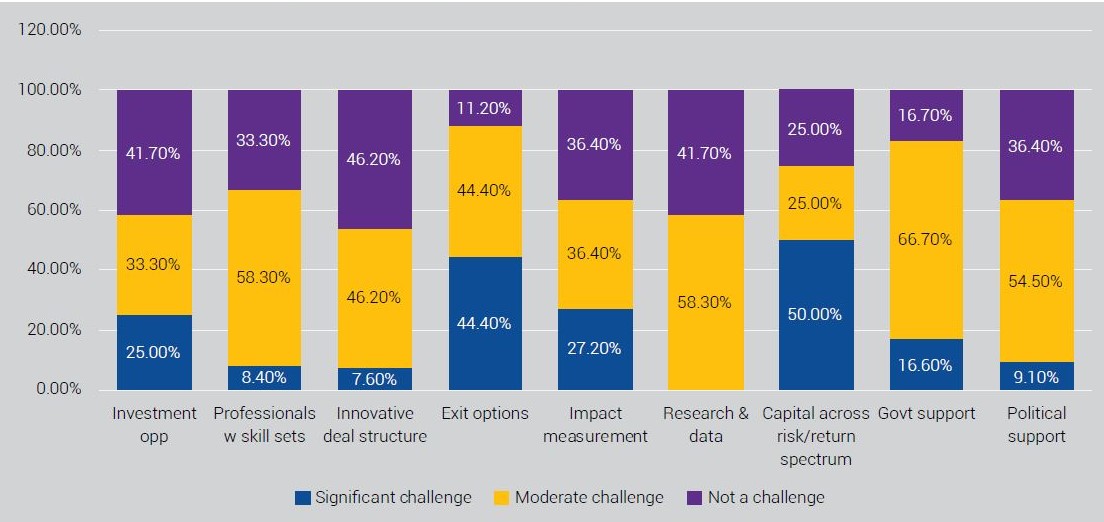

According to Brookings, the top three challenges faced by impact investors in India are availability of appropriate capital across the risk-return spectrum, suitable exit options, and impact measurement.

Challenges faced by Indian impact investors | Source: Brookings survey

According to Brookings, the top three challenges faced by impact investors in India are availability of appropriate capital across the risk-return spectrum, suitable exit options, and impact measurement.How do impact investors measure impact?

The cornerstone of impact investing as a concept, is the measurement of social impact. Ironically, this is also one of the biggest challenges for players in this industry.

Impact is defined loosely—as profitably serving an underserved market. In India, impact indicators are chosen in an ad hoc manner and done to fit services and products that are offered by investees. They differ from investment to investment, with few common indicators and references.

According to Vishal Mehta, co-founder of Lok Capital, “The funding available today is all geared towards market return seeking capital; there is very little around catalytic impact where people are willing to think about subsidising their impact expectation. With almost all global money, there is no compromise on returns. As a result, impact can be defined as anything.”

Collecting or showing impact data is not mandated by industry associations like the Impact Investors Council or government agencies such as the Quality Council of India. As a result, efforts to measure impact remain in exploratory or pilot phases.

The loose definition of social impact, coupled with the aversion of investors to compromise on returns, has blurred the boundaries between impact investment capital and mainstream commercial capital, says Vishal Mehta.

Making impact more standardised in the sector would bring accountability and transparency, and encourage risk-averse or resource-scarce funds to join. For investors, it could make investments comparable, and help make better decisions. For investee organisations, common metrics can help reduce reporting burdens, and effectively demonstrate the impact of their programmes and services.

GIIN, in partnership with Rockefeller Foundation, Acumen Fund, and B Lab, spearheaded the development of the Impact Reporting and Investing Standards (IRIS) project. While IRIS is slowly becoming the unified standard behind which various industry stakeholders measure impact globally, a lot more work needs to be done at an industry level in India.

Other initiatives towards the standardisation of metrics include: Impact Management Project (IMP), Global Impact Investment Rating System (GIIRS), and Portfolio Risk, Impact, and Sustainability Measurement (PRISM).

Despite these resources and tools, many impact investors have not established a standardised mechanism and a set of metrics to measure impact across investees. They pursue impact measurement on a case-by-case basis, working with the entrepreneur to determine metrics that make sense.How can we build a more robust impact investing ecosystem?

Here are some changes that can help build a robust impact investing ecosystem in India:

Move from qualitative to quantitative data

Reporting impact data so far has mostly focused on qualitative and anecdotal data in narrative and case study formats. But to mobilise capital towards the sector, it is imperative to develop methodologies and indicators both on financial returns and social impact. This can help drive early-learnings within and across portfolios, attract additional capital, and present comparisons and trends.

Document results consistently

Investors and investees can be more consistent in the way they document impact and measure data, taking care of aspects such as key assumptions applied, units of measurement, and so on. Creating and promoting an online public database, which houses guidelines and documentation protocols, can further facilitate the impact investment market.

Ease the entry of funds into India

Funds based in India are subject to unfavourable laws that change often, with little to no prior notice. There is also concern over policies and regulatory requirements that differ across states, making compliance more difficult, as well as over the lengthy judicial process in India. As a result, global fund managers are often wary of establishing funds in India, or investing in Indian enterprises.

There is a need for the government to step in and regulate the market through policy interventions.

Enable the growth of intermediaries

There has been a growth in new types of organisations that support impact investors and social enterprises. For instance, intermediaries such as Unitus Capital help broker deals between funds and enterprises, and incubators such as Unltd India and Villgro provide support to enterprises early on in their lifecycle. These players play a critical role in facilitating the growth of the impact investing market.

Increase collaboration amongst investors

Formal collaborations among impact investors offer benefits of shared lessons, costs, and databases. While Indian impact investors reported that they consulted co-investors during due diligence phases of investments, a similar process can be undertaken when impact reporting requirements are determined as well. Leveraging industry players, such as nonprofits active in the field and government agencies, can help coordinate research and learnings.

Footnotes:

- These are in terms of the number of investments made, and may not be the sectors receiving the highest amount of investments.

—

Insights and quantitative data in this explainer have been sourced from The Promise of Impact Investing in India, a Brookings India report published in July 2019.

Saahil Kejriwal contributed to this article.