What is local government and why is it important?

Since the late 1980s, we have been witnessing a wave of decentralisation globally, which is founded upon the idea of making governance more participatory and inclusive. In 1992, India too embraced this wave and amended its constitution with the intent to strengthen grassroots-level democracy by decentralising governance and empowering local political bodies.

The objective was to create local institutions that were democratic, autonomous, financially strong, and capable of formulating and implementing plans for their respective areas and providing decentralised administration to the people. It is based on the notion that people need to have a say in decisions that affect their lives and local problems are best solved by local solutions.

Though traditional forms of local governance have existed in India for centuries, the post-Independence period saw a shift towards building a system of local government, in no small part due to the influence of Mahatma Gandhi. The passing of the 73rd and 74th constitutional amendments, made it mandatory for each state to constitute rural and urban local governments, to establish mechanisms to fund them, and to carry out local elections every five years. The creation of this new three-tier system of local governance provided constitutional status to rural and urban local bodies, ensuring a degree of uniformity in their structure and functioning across the country. Provisions of these two amendments are similar in many ways, and differ mainly in the fact that the former applies to rural local government (also known as Panchayati Raj Institutions or PRIs), while the latter applies to urban local bodies.

Currently, there are more than 250,000 local government bodies across India with nearly 3.1 million elected representatives and 1.3 million women representatives.How is the system structured?

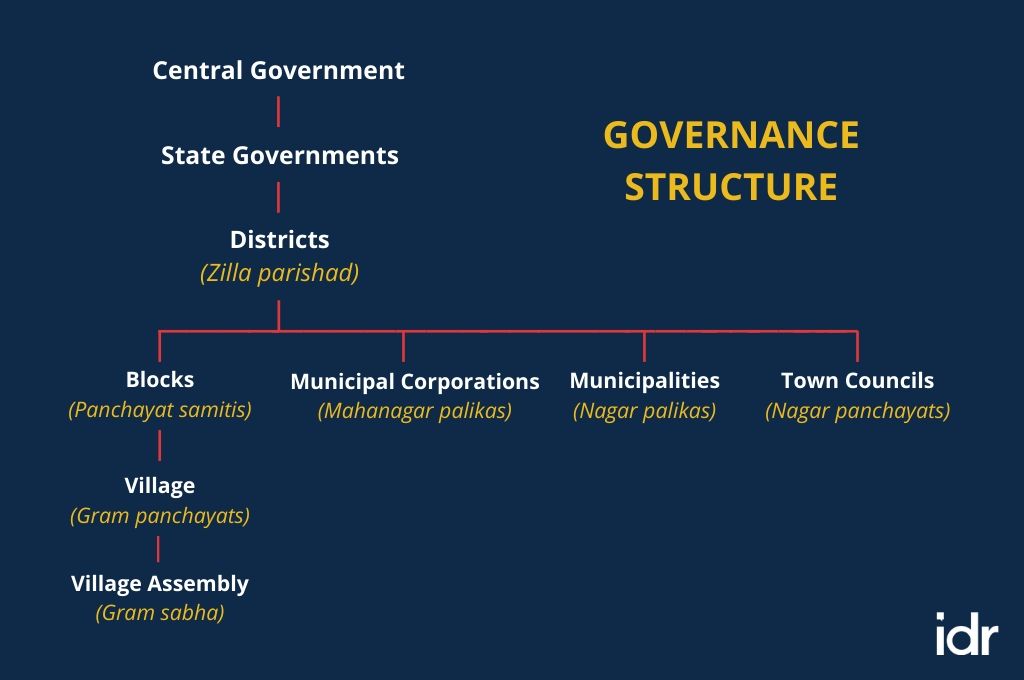

With the introduction of the constitutional amendments, India’s two-tier system of a central and state government was transformed into a three-tier one, now with a local level below the state.

In the case of rural areas, there are three nested bodies. At the apex, is the district council or zilla parishad, which is made up of a cluster of block councils or panchayat samitis, which in turn, are made up of village councils or gram panchayats. Each village has a village assembly or gram sabha comprising all adults in the village, who have the power to directly elect members of the panchayat. States with a population of less than two million (such as Arunachal Pradesh) may also choose to have a two-tiered structure, without the intermediate block-level institution.

In urban areas, there are three types of local bodies: municipal corporations or mahanagar palikas for areas with a population of more than one million, municipal councils/ municipalities or nagar palikas for areas with less than a million people, and town councils or nagar panchayats for areas transitioning from rural to urban. For ease of administration, large municipal areas may be further subdivided into wards.

The structure of PRIs is uniform across all states in the country, except for the scheduled and tribal areas, which are legally exempt from implementing the Panchayati Raj system. The Panchayat Extension to Scheduled Areas (PESA) Act, 1996 provides for the extension of the 73rd Amendment (with certain modifications and exceptions) to tribal and forested areas across 10 states of India, excluding tribal areas in the states of Assam, Meghalaya, Tripura, and Mizoram, which are governed by District or Regional Councils. These provisions have been put in place to protect customary law, social and religious practices, and traditional management practices of community resources.

Local government institutions are made up of both directly and indirectly elected representatives. A minimum of one-third of the seats in all local bodies are reserved for women on a rotational basis—an important innovation given that there is no reservation for women at the central and state level. Over time, states such as Odisha, Punjab, and West Bengal have increased the representation of women in both rural and urban local bodies to 50 percent.

Seats are also reserved for people belonging to scheduled castes, scheduled tribes, and other backward classes in proportion to their population. Under each of these categories, the minimum 30 percent reservation for women is mandatory.What are the functions of local government in India?

In line with their objectives of promoting local economic development and social justice, local government bodies have the power to:

– Prepare development plans for the areas they serve.

– Implement a wide range of schemes relating to 29 core areas for rural local governments, and 18 for urban local bodies. These include (but are not limited to) health, education, poverty alleviation, housing, and the promotion of small-scale industries, among others.

However, since individual state governments (rather than the centre) are responsible for the functioning of their respective local governments, the actual powers and functions of these institutions are highly dependent on the laws of the state in which they operate.

People need to have a say in decisions that affect their lives. | Photo courtesy: ©Gates Archive/Mansi Midha

PRIs play a crucial role in rural development and perform the following roles:

– Administrative activities such as the maintenance of village records, the construction, maintenance, and repair of roads, tanks, wells, and so on.

– Improving socio-economic welfare through the promotion of rural industries, health, education, women and child welfare, among others.

– Judicial functions such as trying petty civil and criminal cases such as minor thefts and money disputes are also performed either by separate adalati or nyaya panchayats, or by gram panchayats.

The functions of urban local bodies can be classified as:

Obligatory functions: Those which they have to perform, including the maintenance of public health and sanitation, providing public utilities such as water and electricity, and education.

Discretionary functions: Which depend on the availability of funds, and include transportation, and the creation and maintenance of public spaces, among others.How are local bodies funded?

In order to effectively carry out their mandates, both urban and rural local bodies require funding. States are required to set up a State Finance Commission once every five years to review the financial position of local government institutions and to make recommendations to the state governments, in order to ensure that local bodies have adequate financial resources to function.

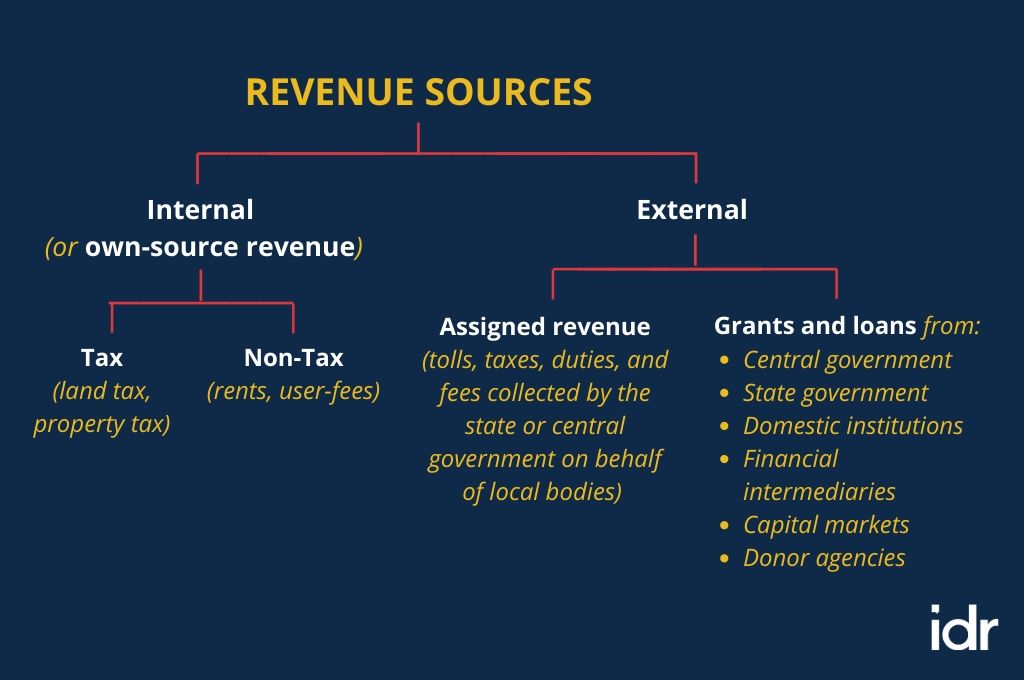

Broadly, local bodies have two main sources of revenue: internal and external. Internal (or own-source revenue) is that which they raise themselves, either through taxes such as land or property tax, or through non-tax sources which include rents and user-fees. External revenue sources include:

– Assigned revenue, which covers taxes, duties, tolls, and fees due to local bodies, that are collected by the state and central governments. The exact percentage allocation of these revenues is done through recommendations of State Finance Commissions.

– Grants-in-aid and loans from the central and state governments, domestic institutions, financial intermediaries, capital markets, and/or donor agencies.

Due to the differing nature of functions performed, the exact sources of revenue vary for rural and urban local bodies. For example, large urban centres such as Delhi and Mumbai are able to mobilise newer and more innovative forms of finance such as private finance, while smaller municipalities and rural bodies continue to depend on traditional sources such as central and state government tax shares, loans, and grants.What are some of the challenges faced by local government bodies?

In India, though political decentralisation has been successfully achieved through the establishment of local government bodies, the actual transfer of functions, finances, and functionaries to these institutions remains incomplete. This weakens the system and inhibits its proper functioning.

A Devolution Report, published by the Ministry of Panchayati Raj in 2015-2016 estimates the extent to which states have devolved functions, finances, and functionaries. It concludes that while certain states such as Kerala, Karnataka, and Maharashtra have transferred relatively more power to local bodies, real decentralisation has a long way to go in India.

Functional challenges: The power to devolve functions to local governments rests with the state government. For a variety of reasons, states do not devolve adequate functions to local government bodies, severely affecting the system’s efficiency and effectiveness. For instance, state governments have been known to create parallel structures for the implementation of projects around agriculture, health, and education—undermining areas for which local bodies are constitutionally responsible.

Additionally, many local bodies lack the support systems necessary to carry out their mandates. The 74th amendment requires a District Planning Committee to be set up in each district, so that the development plans prepared by the panchayats and urban local bodies can be consolidated and integrated. However, it was seen that District Planning Committees are non-functional in nine states, and failed to prepare integrated plans in 15 states.

Financial challenges: Devolving functions is meaningless without providing adequate funds to carry out said functions. After nearly 25 years of decentralisation, local government expenditure as a percentage of GDP is only two percent—a number that is extremely low when compared to other major emerging economies such as China (11 percent) and Brazil (seven percent).

Most local bodies, both rural and urban are unable to generate adequate funds from their internal sources, and are therefore extremely dependent on external sources for funding. Studies show that around 80 percent to 95 percent of revenue is obtained from external sources, particularly state and central government loans and grants.

There are two main reasons for low internal revenue collection:

– Local bodies may lack the capacity to properly impose taxes, due to ambiguous taxation norms, lack of reliable records, and so on.

– State governments have not devolved enough taxation powers. Most states only permit local bodies to collect property taxes and water tariffs, but not land tax or tolls, which can provide more substantial revenues.

Functionary challenges: The capacity of local bodies to carry out their mandate is often circumscribed by the state government officials. Additionally, the secretariats of local governments are grossly under-staffed and under-skilled, and therefore unable to provide the required support to the elected body. Their capacities need to be further strengthened through training of existing personnel and the recruitment of new staff. Though local bodies are authorised to recruit staff, this is prevented by limited funding.

India’s local governance system needs to be empowered in all three areas to ensure that power truly rests with the people, not just on paper, but also in practice.

Tanaya Jagtiani contributed to this article, with inputs and insights from Dr Shankara Prasad, Sonali Srivastava, Jyothsna Devi, Ila Reddy, and Anant Maringanti.

—

Know more

- Explore the government’s India Panchayat Knowledge Portal—a one-stop repository for everything you need to know about rural local governance in India.

- Listen to ‘The Seen and the Unseen’ podcast, which discusses the importance of cities, the state of urban governance in India, and how urban governance can be reformed.

- Learn more about how urban governance, democratic local governance, and the Panchayati Raj Institutions work in practice through PRIA’s Knowledge Resource Centre.

- Dip in to Praja’s research carried out across two years and 21 states, to understand the challenges in the implementation of the 74th amendment.