As nonprofits grow, their functioning and effectiveness are often subject to more scrutiny. Here are nine lesser-known regulatory best practices they should follow, especially when it comes to CSR funding and Foreign Contribution (Regulation) Act, 2010 (FCRA) compliance:

When deciding the terms and conditions for CSR partnerships, companies often choose to get into a vendor agreement, where the nonprofit is seen as a service provider. This should be avoided, both by the nonprofit, as well as the funder, since vendor agreements come with additional costs such as GST and TDS, and extra regulatory requirements for nonprofits to be registered under GST. Not only is a grant agreement simpler, it also ensures that money that would otherwise go towards GST and TDS is directed towards the programme.

Related article: The laws that govern India’s nonprofits

At the end of a project or the financial year, request your chartered accountant to give you a Utilisation Certificate. This Utilisation Certificate can include the total funds sanctioned, the amount utilised, the amount carried forward (in the case of a multiyear project), bank interest earned, and the amount spent on the project, among other things. You might also choose to call out any capital expenditures (laptops, computers, etc). While not mandatory, it is a desirable thing to have, because the auditor is certifying that the CSR funds received by you have been accounted for in the proper manner. This document can also be produced in case of a scrutiny.

Nonprofits are legally required to comply with regulations such as the Income Tax Act, 1961 or the Companies Act, 2013. However, it is important to go beyond these and look at building internal self-governance practices, such as a robust human resource policy, a fundraising policy, a prevention of sexual harassment policy (in case the organisation is bigger than 10 people), and a board policy. These will enable the nonprofit to function more efficiently.

If you are a nonprofit that is eligible to receive money under FCRA, ensure that you report any changes in the membership of your board to the Ministry of Home Affairs within 15 days of the change taking place. While the official rule says that board changes have to be reported only when it reaches 50 percent, this requirement has been modified in practice.

Additionally, make sure that foreign citizens, politicians, journalists, and government officials are not board members, and that the chief functionary of your organisation is not the chief functionary of another FCRA nonprofit.

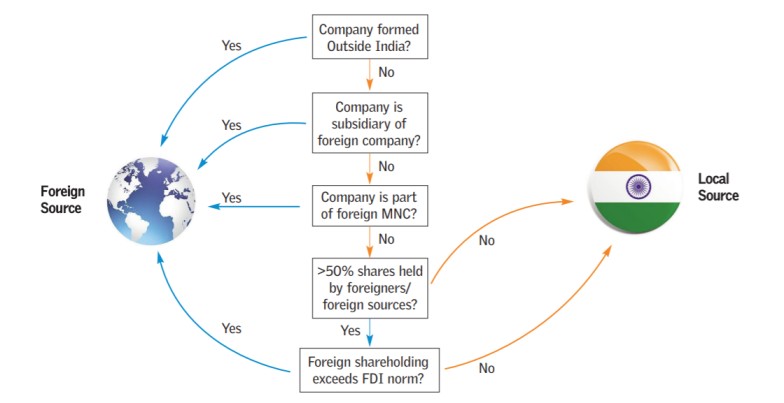

A lot of companies doing CSR in India are confused about whether they are a foreign source or an Indian source. In particular, there has been much debate around whether subsidiaries of companies are foreign source under FCRA.

The FCRA rules make it clear that a foreign source is a business that has either been formed abroad, is a subsidiary of a foreign company, or a foreign multinational company. This flowchart can be a helpful tool to determine which source your company is classified under, and to therefore disburse funds in line with FCRA norms.

Source: AccountAble, 2018

Both companies and nonprofits should remember that just because money is being given in rupees, that doesn’t make it an Indian source.

Any money that is generated out of the utilisation of FCRA funds, will be treated as a foreign contribution, and should be accounted for and reported separately as receipts. This means that, for example, if you buy a cow with FCRA money, milk the cow, make barfi from the cow’s milk, and sell the barfi, the income from the barfi will be counted as a foreign contribution.

When it comes to accounting for FCRA funds, keep only one consolidated set of books, rather than project wise accounts, which is a common practice among many organisations.

Related article: IDR Explains | FCRA

File for renewing your FCRA license as early as possible, preferably within six to 12 months before its expiration. This allows for adequate time to complete the process. Make sure the renewal fees are paid, give the correct email address and mobile number (since this cannot be changed), and keep checking the status of your application every couple of days. While checking, in case there is a question about the application, make sure to respond within 15 days. If the application is not renewed in time, stop taking FCRA funds.

It is also important to note that as part of the process of applying for renewal, trustees are required to submit an affidavit stating that they will report any violation of the provisions of Section 12(4) of FCRA by their organisation or any of its members, office bearers, or key functionaries that comes to their knowledge. This amendment has been met with a degree of resistance, and getting the affidavit signed may require longer conversations with existing trustees, and/or replacing them with new trustees.

It is important to go beyond mandatory regulation and look at building internal self-governance practices. | Picture courtesy: Rawpixel

There is nothing concrete laid down under Section 135 of the Companies Act, 2013 nor in the CSR Rules about what counts as an administrative expense and what counts as a programme expense. To avoid ambiguity, it is best to lay this out while agreeing to the terms of partnership. A general principle to follow is that the salaries of anyone who is on the ground, involved in implementation of the project (such as, a teacher or an outreach worker) would fall under programme cost.

For companies doing CSR, there is an additional requirement to cap their internal administrative overheads at 5 percent.

This distinction becomes more important when complying with FCRA, which mandates that more than 50 percent of foreign contributions cannot be spent on administrative expenditure. Given that nonprofits generally spend 10-15 percent on administrative costs, this might seem excessive. However, under FCRA, administrative expenses are defined very specifically, and includes rent, overheads, fees, and travel, along with all staff salaries. It is this inclusion of all staff salaries, that might result in nonprofits overshooting the 50 percent limit, and is something nonprofits should bear in mind.

For companies doing CSR, there is an additional requirement to cap their internal administrative overheads at 5 percent. The limit may be extended by another 5 percent in case the company is undertaking needs and/or impact assessments. Note that these restrictions on administrative expenditure are applicable only to the funder and not the nonprofits receiving CSR funds.

Nonprofits with an FCRA license are also required to publicly share the quarterly receipts of their foreign contributions by the 15th day of the end of the quarter, either on their own website, or on the FCRA website. Another lesser known requirement is that nonprofits must publish their FCRA audited financial statements on their own website every year (if they have a website).

At charcha 2020, Noshir Dadrawala and Sanjay Agarwal spoke about CSR and FCRA compliance for nonprofits.

—

Know more

- Learn more about why the nonprofit sector in India needs comprehensive legal reforms.

- Explore the Center for the Advancement of Philanthropy’s blog, which features the latest legal and compliance-related developments in India.

- Read an analysis of publicly available data and trends around the FCRA.

- Watch this webinar on some of the key FCRA and tax challenges faced by nonprofits and public trusts in India.

- Check out AccountAble—a periodical that covers various aspects of nonprofit regulation and accounting.

Do more

- Need legal and compliance advice? Reach out to Centre for Advancement of Philanthropy (CAP) at connect@capindia.in.

- Sign up for a WhatsApp group created by CAP for updates and/or discussions on the issue of nonprofit regulation and compliance. To be added to the group, email cap.csip@ashoka.edu.in with your name, organisation name, WhatsApp number, and location.